Comparing Popular 2D Payment Gateways: Attributes and Prices Discussed

Comparing Popular 2D Payment Gateways: Attributes and Prices Discussed

Blog Article

An In-Depth Check Out the Functionality and Advantages of Applying a Repayment Portal

The execution of a repayment portal represents a crucial advancement in the realm of electronic deals, providing organizations not only enhanced safety yet also an extra reliable handling device. By incorporating features such as multi-payment assistance and real-time transaction capabilities, organizations can substantially improve client fulfillment while lessening the threat of cart abandonment.

Understanding Settlement Entrances

The essence of modern shopping depends upon the smooth combination of payment entrances, which work as the vital channels between customers and merchants. A payment portal is an innovation that assists in the transfer of information between a repayment site (such as an internet site or mobile application) and the financial institution. This system ensures that delicate information, consisting of credit card information, is securely transferred, thus keeping the honesty of the deal.

Repayment gateways are vital for processing on-line repayments, enabling customers to full purchases effectively while offering sellers with an automated solution for taking care of financial transactions. They support numerous settlement approaches, consisting of credit rating cards, debit cards, and different settlement options, catering to varied consumer preferences.

Additionally, repayment entrances improve the general purchasing experience by providing features such as real-time purchase processing and fraudulence discovery devices. They are commonly created to incorporate seamlessly with existing shopping platforms, making certain a smooth user experience. By leveraging these technologies, services can broaden their reach, rise sales, and foster consumer trust fund. Understanding the capability of settlement gateways is critical for any kind of company aiming to thrive in the affordable landscape of online retail.

Secret Attributes of Payment Portals

A detailed understanding of settlement gateways additionally includes identifying their crucial features, which considerably improve both performance and customer experience. One of the primary attributes is transaction processing speed, which enables merchants to complete sales promptly, thus lowering cart desertion rates. In addition, settlement portals promote a wide range of settlement approaches, consisting of charge card, debit cards, and digital wallets, satisfying a varied client base.

One more vital function is the easy to use user interface, which simplifies the settlement procedure for consumers, making it user-friendly and obtainable. This simplicity of use is enhanced by robust assimilation abilities, allowing seamless link with numerous e-commerce systems and point-of-sale systems. Moreover, numerous repayment gateways provide personalized check out experiences, enabling services to straighten the repayment process with their branding.

Real-time coverage and analytics are likewise critical attributes, offering merchants with insights right into deal patterns and customer behavior, which can notify company techniques. Scalability is an essential particular, allowing settlement gateways to grow together with a business, accommodating raised transaction quantities without jeopardizing performance - 2D Payment Gateway. Overall, these crucial features highlight the significance of choosing a settlement entrance that straightens with service requirements and improves the total customer experience

Safety And Security Procedures in Payment Handling

Guaranteeing safety in Source repayment processing is extremely important for both consumers and vendors, as it safeguards sensitive financial information versus fraudulence and cyber hazards. Repayment portals use diverse protection actions to create a durable structure for safe purchases. One of the leading approaches is security, which transforms delicate information right into a coded style that is unreadable to unauthorized individuals. This ensures that information such as credit report card numbers and personal information stay personal throughout transmission.

In addition, payment gateways utilize Secure Outlet Layer (SSL) technology to establish secure links, additionally safeguarding information traded in between the merchant and the consumer. Tokenization is another vital step; it changes sensitive card details with an one-of-a-kind identifier or token, lessening the risk of data breaches.

Benefits for Companies

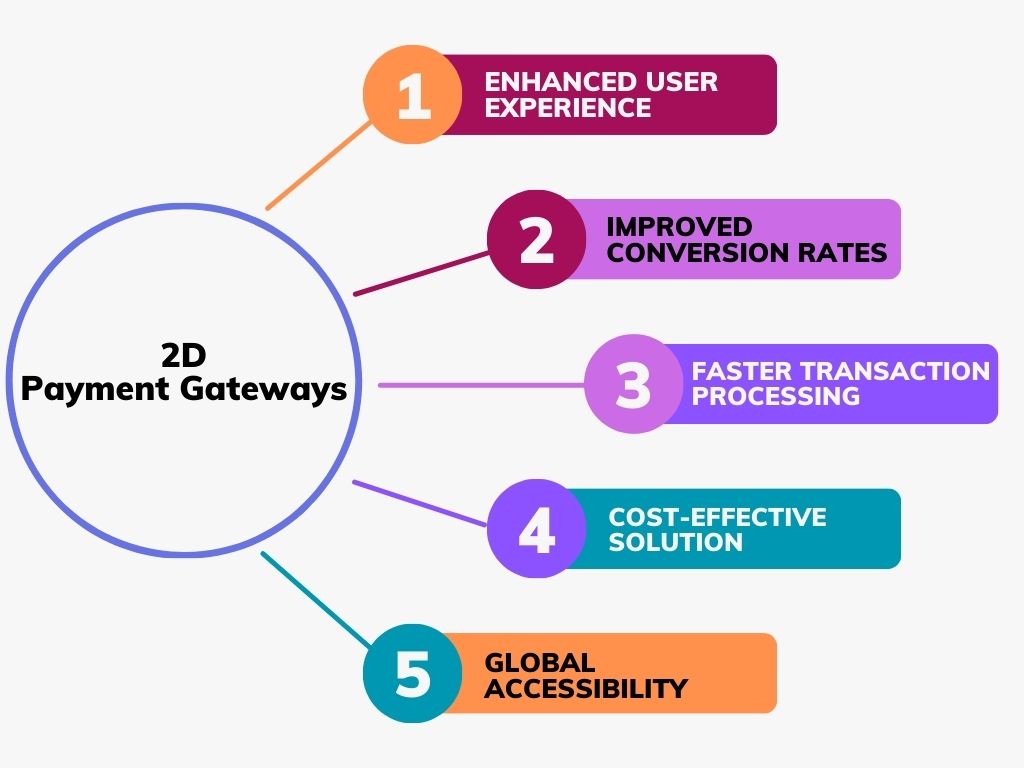

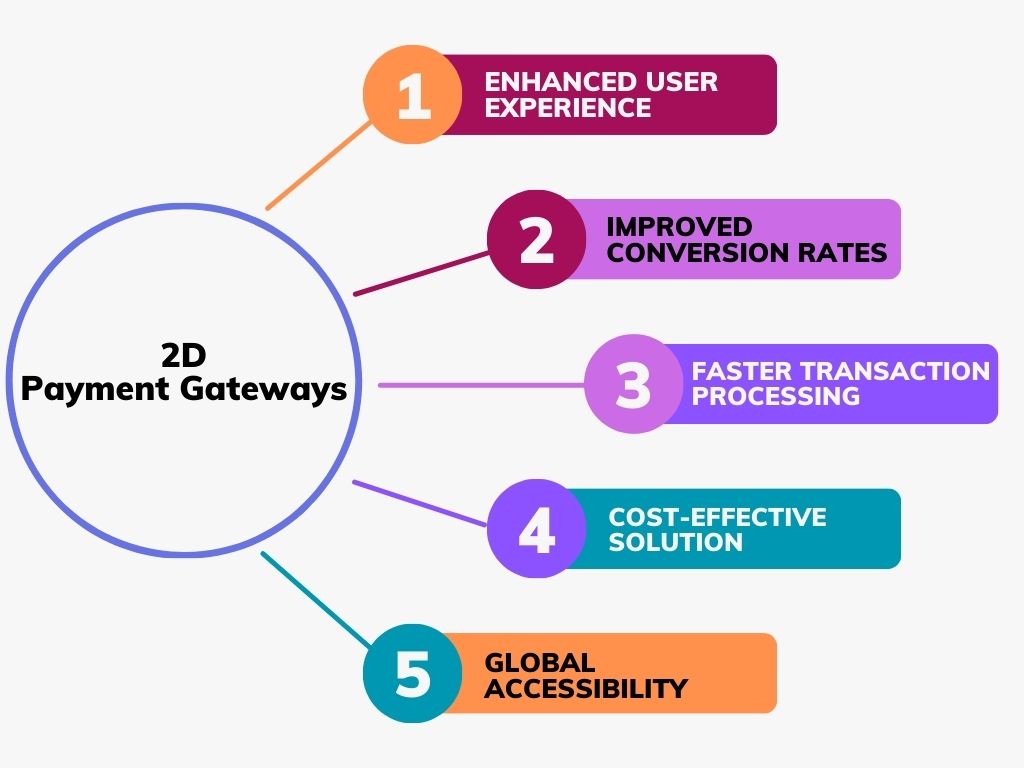

Businesses can greatly benefit from the combination of repayment entrances, which streamline the transaction process and enhance functional efficiency. One of the primary advantages is the automation of payment handling, decreasing the need for manual treatment and lessening human error. This automation permits businesses to concentrate on core activities instead than administrative tasks, ultimately boosting performance.

In addition, repayment entrances promote numerous settlement methods, consisting of bank card, digital purses, and financial institution transfers. This adaptability satisfies a more comprehensive customer base and urges greater conversion rates, as consumers can select their recommended repayment technique. Repayment entrances commonly offer comprehensive reporting and analytics, allowing organizations to track sales fads and client behavior, which can inform critical decision-making.

Settlement portals enhance protection procedures, click to find out more shielding delicate monetary details and lowering the threat of fraud. Generally, incorporating a settlement gateway is a calculated relocation that can lead to boosted development, efficiency, and productivity opportunities for organizations.

Enhancing Client Experience

How can repayment gateways boost the consumer experience? By streamlining the settlement procedure, settlement gateways substantially enhance the total buying trip.

In addition, repayment gateways sustain numerous settlement approaches, including debt cards, digital budgets, and financial institution transfers, providing to diverse consumer choices. This adaptability not only meets the requirements of a broader target market yet likewise promotes a sense of depend on and complete satisfaction among customers.

In addition, a safe and secure payment environment is vital. Repayment portals utilize advanced encryption technologies, guaranteeing customers that their sensitive information is secured. This degree of security develops confidence, motivating repeat organization and customer commitment.

Furthermore, many repayment entrances offer real-time transaction updates, enabling consumers to track their payments instantaneously. This transparency boosts interaction and lowers unpredictability, adding to a positive customer experience. Generally, by carrying out a protected and reliable payment entrance, services can substantially enhance customer fulfillment and commitment, inevitably driving growth and success in an affordable market.

Verdict

In summary, the application of a settlement entrance offers numerous benefits for companies, including structured deal procedures, enhanced protection, and detailed analytics. These systems not just assist in varied payment methods however likewise substantially boost consumer trust fund and satisfaction. By reducing cart desertion rates and maximizing operational efficiency, organizations can achieve higher conversion rates and increased profitability. Eventually, repayment gateways function as important devices for contemporary enterprises aiming to flourish in a competitive digital industry.

Additionally, repayment gateways promote a plethora of repayment methods, including credit report cards, debit cards, and electronic pocketbooks, providing to a diverse consumer base.

Several repayment portals supply adjustable checkout experiences, enabling companies to align the settlement procedure with their branding.

Furthermore, settlement gateways facilitate different settlement methods, including credit report cards, digital budgets, and financial institution transfers. By improving the settlement process, payment gateways considerably boost the general shopping trip.Furthermore, many settlement portals supply real-time purchase updates, permitting clients to track their settlements quickly.

Report this page